If you’re looking to establish or improve your credit, a credit builder loan could be the perfect tool for the job. Unlike traditional loans, credit builder loans aren’t about borrowing money for immediate use—they’re all about building your credit score while helping you save. Let’s break down how they work and why they might be a great option for you.

How Does a Credit Builder Loan Work?

1. The Money Is Held for You

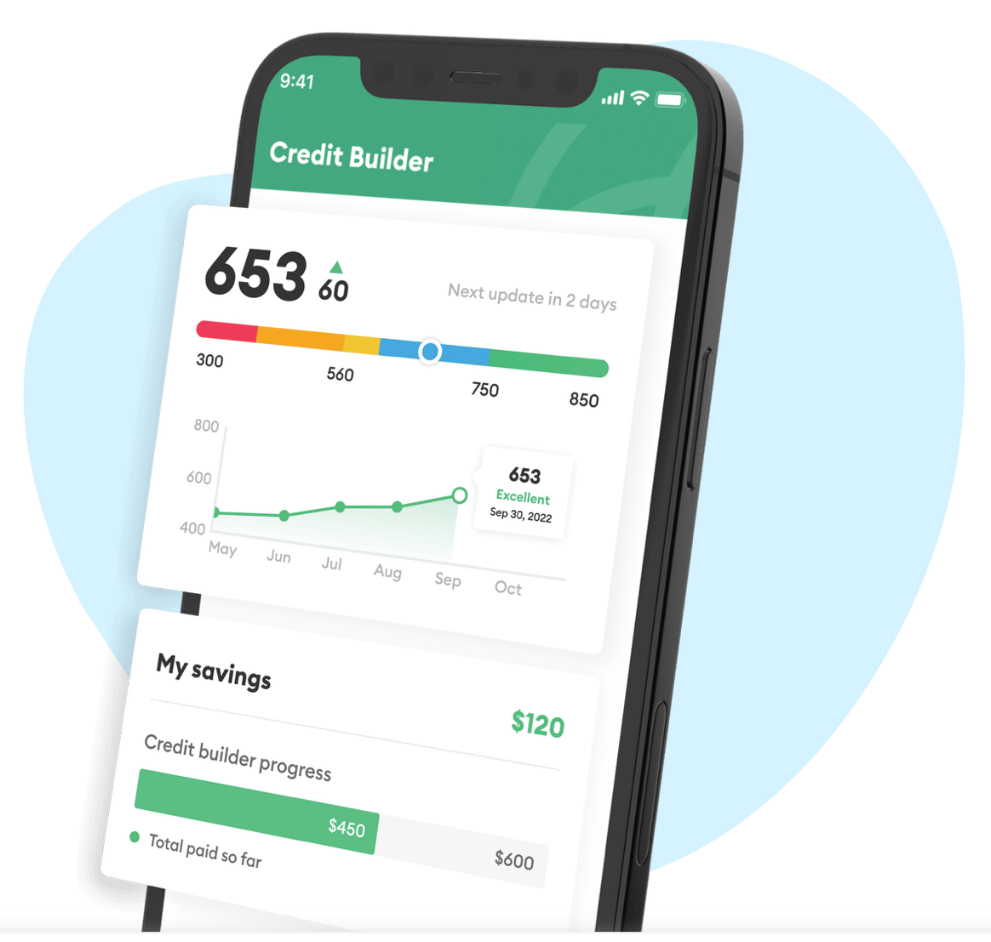

When you take out a credit builder loan, the lender doesn’t hand you the funds right away. Instead, the loan amount is placed into a secure savings account or certificate of deposit (CD) that you can’t access until the loan is fully paid off.

2. You Make Monthly Payments

Over the loan term (typically 6 to 24 months), you’ll make fixed monthly payments, which include interest. These payments are reported to the major credit bureaus—Equifax, Experian, and TransUnion. This is key to building a positive credit history.

3. Get Your Funds Back After Paying Off the Loan

Once you’ve made all your payments, the lender releases the funds to you. The amount you receive may be slightly less than what you paid, depending on interest and fees, but now you’ll have both improved credit and a lump sum of savings.

Why Consider a Credit Builder Loan?

Here are some of the key benefits that make credit builder loans a smart option:

• Build or Improve Credit: Whether you’re starting from scratch or recovering from financial setbacks, a credit builder loan is a simple way to establish a strong credit profile.

• Forced Savings Plan: By the end of the loan term, you’ll not only have better credit but also a small savings stash—perfect for an emergency fund or another financial goal.

• Low Approval Barriers: Because the loan is secured by the money in the savings account, lenders are more likely to approve people with little to no credit history.

Things to Keep in Mind

While credit builder loans have plenty of benefits, there are a few considerations:

• Interest and Fees: You’ll pay interest on the loan, and some lenders may charge additional fees. Be sure to compare rates before choosing a lender.

• Commitment: The key to seeing credit improvements is making every payment on time. Missed payments can have the opposite effect on your credit score.

Who Can Benefit from a Credit Builder Loan?

Credit builder loans are ideal for:

• People with no credit history—like young adults or recent immigrants.

• Individuals with poor credit who need to rebuild their score.

• Anyone looking to improve their credit to qualify for better financial products, such as mortgages, car loans, or credit cards.

How to Get Started

Interested in getting a credit builder loan? Start by researching local banks, credit unions, or online lenders that offer this product. Compare interest rates, loan terms, and any fees to find the best option for you.

Final Thoughts

A credit builder loan is more than just a financial product—it’s a stepping stone toward a healthier financial future. Whether you’re just starting your credit journey or working to repair your score, it’s a simple and effective way to build credit while saving money.

Leave a comment