For individuals seeking to maximize their retirement savings, a Backdoor Roth IRA can be an excellent strategy. It allows high-income earners, who would otherwise be ineligible, to benefit from the tax advantages of a Roth IRA. Here’s everything you need to know about what it is and how it works.

What Is a Backdoor Roth IRA?

A Backdoor Roth IRA isn’t a special type of account but rather a legal financial maneuver. It allows individuals to contribute to a Roth IRA indirectly, even if their income exceeds the limits set by the IRS for direct contributions. This strategy involves converting funds from a traditional IRA into a Roth IRA, enabling tax-free growth and withdrawals in retirement.

The appeal lies in the tax advantages of Roth IRAs:

• Contributions grow tax-free.

• Withdrawals in retirement are also tax-free, provided you meet certain conditions.

However, income limits prevent high earners from contributing directly to a Roth IRA. For 2024, the income limits for direct contributions are:

• $153,000 for single filers (phase-out starts at $138,000).

• $228,000 for married couples filing jointly (phase-out starts at $218,000).

The Backdoor Roth IRA provides a workaround for these restrictions.

How Does a Backdoor Roth IRA Work?

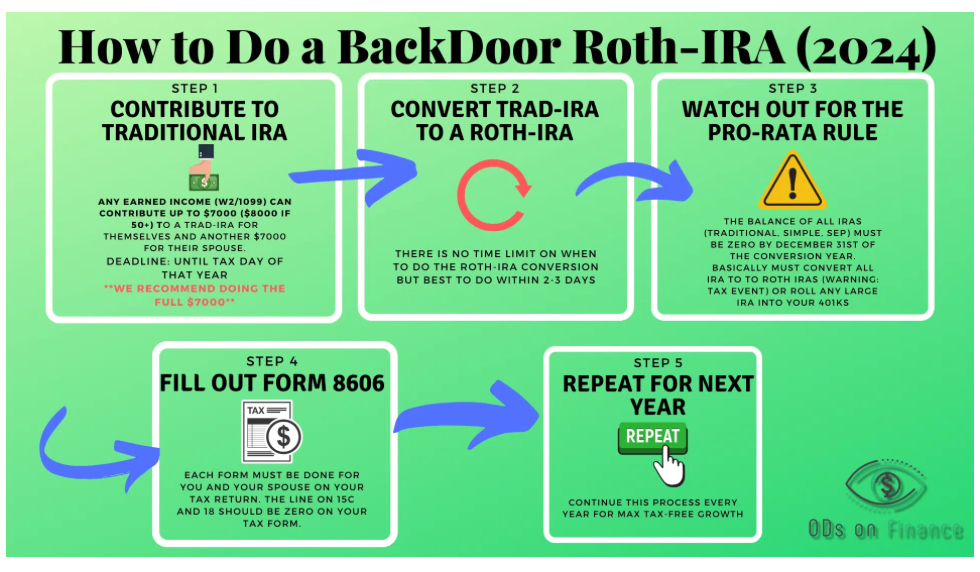

Here’s a step-by-step guide to setting up a Backdoor Roth IRA:

1. Contribute to a Traditional IRA

You start by making a contribution to a traditional IRA. There are no income limits for traditional IRA contributions, making this step accessible to anyone. However, contributions may not be tax-deductible if your income is above a certain threshold.

2. Convert the Traditional IRA to a Roth IRA

Once the funds are in the traditional IRA, you can convert them to a Roth IRA. This conversion is the essence of the Backdoor Roth strategy.

3. Pay Taxes on the Conversion

If you made non-deductible contributions to your traditional IRA, you’ll owe taxes only on the earnings during the conversion. However, if you have pre-tax money in your traditional IRA (from deductible contributions or rollovers), the conversion will trigger taxes on the pre-tax portion. This is where the pro-rata rule comes into play.

4. Ensure Proper Reporting

When filing your taxes, you’ll need to report the contribution and conversion correctly using IRS Form 8606. This form calculates the taxable and non-taxable portions of the conversion.

Key Considerations for a Backdoor Roth IRA

1. The Pro-Rata Rule

The pro-rata rule can complicate matters if you have other pre-tax money in traditional IRAs. The IRS considers all traditional IRAs as a single account when determining the taxable portion of your conversion.

2. Timing Matters

To avoid potential penalties for excess contributions, ensure you follow the IRS rules carefully when contributing and converting.

3. Legislative Risks

While Backdoor Roth IRAs are currently allowed, there have been proposals to eliminate this strategy. It’s wise to stay informed about tax law changes.

4. Consult a Financial Advisor

Because of the potential complexities and tax implications, it’s a good idea to work with a financial advisor or tax professional to ensure you execute the strategy correctly.

Why Use a Backdoor Roth IRA?

Here are some reasons to consider a Backdoor Roth IRA:

• High-Income Savers: It provides a way for high earners to take advantage of Roth IRA benefits despite income limits.

• Tax-Free Growth: Earnings grow tax-free, unlike traditional IRAs where taxes apply to withdrawals.

• No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require withdrawals starting at age 73.

Final Thoughts

A Backdoor Roth IRA can be a valuable tool for maximizing retirement savings and taking advantage of tax-free growth and withdrawals. However, it’s not for everyone, and executing it correctly requires attention to detail. If you’re considering this strategy, consult a financial professional to determine if it aligns with your long-term goals and financial situation.

By understanding and utilizing the Backdoor Roth IRA, you can secure greater financial flexibility and tax savings in retirement.

Leave a comment