Managing personal finances can sometimes feel overwhelming, especially when banking terminology gets confusing. One common source of confusion for many is understanding the difference between a bank statement balance and a bank account balance. While these terms may seem interchangeable, they represent different aspects of your account’s financial status. Let’s break them down to help you better manage your finances.

What Is a Bank Statement Balance?

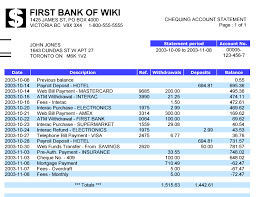

Your bank statement balance refers to the total amount of money in your account as of the last date of your bank’s monthly statement. This balance includes all transactions that have been fully processed and cleared up to that date, such as deposits, withdrawals, checks, and transfers.

For example:

• If your statement is generated on the 30th of the month, your statement balance reflects all transactions cleared through that date.

• Any activity occurring after the 30th won’t be reflected until the next statement period.

The bank statement balance is essentially a snapshot of your account at a specific moment in time.

What Is a Bank Account Balance?

Your bank account balance, often referred to as the available balance, represents the current amount of money in your account, including recent transactions. However, it may not always match your statement balance due to pending transactions that haven’t fully processed.

Pending transactions can include:

• Debit card purchases that haven’t cleared yet.

• Deposits that are still being processed.

• Checks you’ve written but haven’t been cashed yet.

For instance, if you swipe your debit card to buy groceries, the transaction might immediately reduce your available balance, even though it could take a day or two to fully post to your account.

Why the Differences Matter

Understanding these differences is crucial for avoiding overdraft fees, budgeting effectively, and maintaining a healthy financial outlook. Here’s why:

1. Pending Transactions Can Lead to Errors

Relying solely on your account balance without accounting for pending transactions can give a false sense of how much money you have available. For example, you may see $1,000 in your account balance, but if there are $500 in pending transactions, you really only have $500 to spend.

2. Reconciling Your Budget

If you track your spending manually or use budgeting software, the statement balance is essential for reconciling your accounts at the end of the month. However, your account balance is what you’ll monitor for day-to-day spending.

3. Preventing Overdrafts

Ignoring pending transactions can result in spending more money than you actually have. By keeping track of both balances, you can avoid costly overdraft fees or bounced checks.

Tips for Managing Both Balances

To stay on top of your finances, consider these best practices:

1. Keep a Personal Ledger

Maintain a record of your transactions, including pending ones. Apps or spreadsheets can make this easier.

2. Check Your Account Regularly

Review your account online or via mobile banking to track real-time balances and catch any errors or fraudulent activity.

3. Be Mindful of Pending Transactions

Remember that your available balance may not account for pending payments, so always factor those in before spending.

4. Reconcile Monthly

Use your bank statement to reconcile your account at the end of each month. This ensures your records match the bank’s and helps catch any mistakes.

In Summary

The bank statement balance is a historical snapshot of your account at the end of a statement period, while the bank account balance reflects the funds currently available, including pending transactions. Understanding the difference helps you avoid overdrafts, manage your budget effectively, and maintain better control over your finances.

By monitoring both balances and staying proactive with your spending, you can build better financial habits and avoid costly errors. Remember, when in doubt, double-check your transactions and keep a cushion in your account for unexpected expenses!

Leave a comment