Whether you’re investing in the stock market, building a business, or managing your personal finances, one timeless principle can help protect your future: diversification.

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” That’s diversification in a nutshell. But let’s break it down into what it really means, why it matters, and how to apply it across different areas of your life.

What Is Diversification?

Diversification is the strategy of spreading your resources across a variety of assets, industries, or opportunities to reduce risk. The goal is simple: avoid the danger of any single point of failure.

In the financial world, this might look like investing in a mix of:

- Stocks from different sectors (tech, healthcare, energy, etc.)

- Bonds and other fixed-income securities

- Real estate or alternative assets

- International markets

But diversification isn’t limited to investing. It applies to:

- Business: Offering different products or serving various customer types

- Income: Earning money from multiple streams

- Skills: Developing varied expertise to stay employable in a changing world

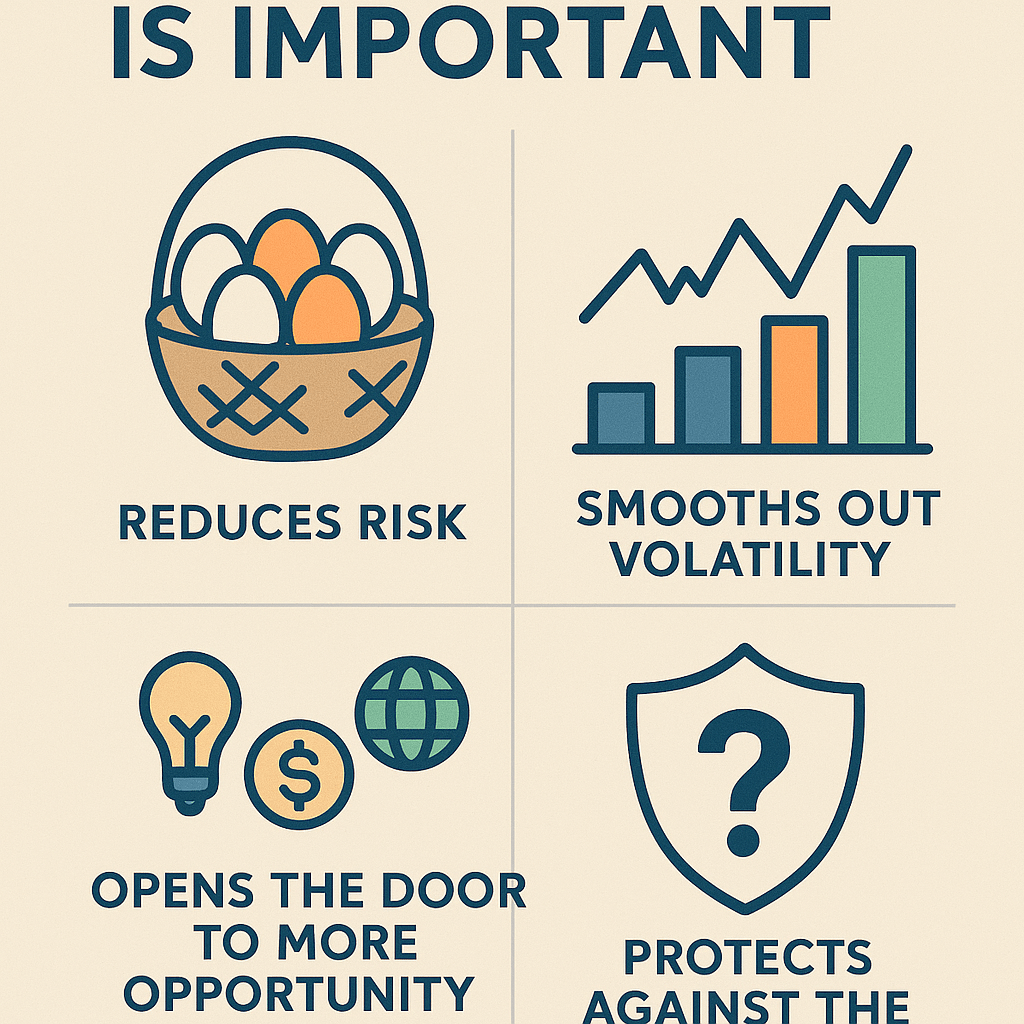

Why Diversification Matters

1.

Reduces Risk

If one investment or revenue stream takes a hit, others can keep you afloat. Imagine if you had all your money in airline stocks in 2020 — you’d be in trouble. A diversified portfolio helps cushion the blow.

2.

Smooths Out Volatility

Markets and industries naturally go through ups and downs. Diversification helps even out the ride. While some assets dip, others may rise, keeping your overall position more stable.

3.

Opens the Door to More Opportunity

By spreading out, you increase your chances of participating in winning investments or trends. You don’t have to pick “the one.” You can own parts of many.

4.

Protects Against the Unknown

The future is unpredictable. Diversification is a proactive way to prepare for surprises — whether it’s a market crash, supply chain disruption, or unexpected expense.

Examples of Diversification in Action

- An investor holds a portfolio that includes U.S. stocks, international stocks, real estate, and bonds.

- A freelancer offers writing, graphic design, and consulting services across different industries.

- A small business sells both digital and physical products and markets to different customer segments.

How to Diversify Wisely

- In investing: Use index funds or ETFs to get instant diversification. Rebalance regularly.

- In business: Experiment with new offerings or explore adjacent markets without abandoning your core.

- In life: Cultivate multiple income streams, grow new skills, and build relationships in varied industries.

Final Thoughts

Diversification isn’t about being scattered — it’s about being strategic. It’s a smart, balanced approach that helps you weather storms and seize opportunities, all while sleeping a little better at night.

No matter where you are in your financial or professional journey, start thinking about how you can spread your risk and increase your resilience. Diversification might just be your safety net — and your springboard.

Leave a comment